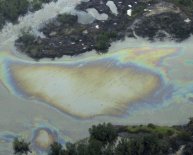

![By the BP oil spill [AP]](http://www.hispecsales.com//img/bp_ordered_to_pay_20bn_over.jpg)

Federal oil spill Tax

Ecological taxes are imposed on crude oil and petroleum services and products (oil spill responsibility), the purchase or usage of ozone-depleting chemicals (ODCs), and imported products containing or produced with ODCs. Besides, a floor shares tax is imposed on ODCs held on January 1 by anybody (except that the producer or importer regarding the ODCs) for sale and for use in additional manufacture.

Figure environmentally friendly income tax on Form 6627. Enter the taxation in the appropriate outlines of Form 720 and connect Form 6627 to create 720.

For environmental taxation reasons, usa includes the 50 says, the District of Columbia, the Commonwealth of Puerto Rico, any ownership of usa, the Commonwealth of this Northern Mariana isles, the Trust Territory of Pacific isles, the continental rack places (using the maxims of part 638), and international trade zones. No body is exempt through the ecological fees, including the federal government, state and regional governments, Indian tribal governments, and nonprofit academic businesses.

Imported petroleum items. Tax is imposed on petroleum services and products once they enter the united states of america for consumption, usage, or warehousing. Anyone going into the petroleum item to the country is likely when it comes to tax, such as the income tax on brought in crude oil, even if it really is afterwards obtained at a U.S. refinery. Tax is imposed only once on any brought in petroleum item. Therefore, the operator of a U.S. refinery that receives brought in crude oil must establish your petroleum taxation was already enforced on such crude oil if you wish not to be accountable for the tax.For a summary of the taxable ozone-depleting chemicals (ODCs) and taxation rates, see the Form 6627 guidelines.

Taxable event. Tax is imposed on an ODC when it's first utilized or offered by its producer or importer. The manufacturer or importer is liable for taxation. Use of ODCs. You employ an ODC in the event that you place it into solution in a trade or company or even for producing earnings. Also, an ODC is used if you use it into the generating of articles, including incorporation to the article, chemical transformation, or launch in to the air. Losing, destruction, packaging, repackaging, or warehousing of ODCs actually a use regarding the ODC. The creation of a mixture containing an ODC is addressed as a taxable use of the ODC contained in the combination. An ODC is within a mix as long as the chemical identity associated with the ODC is not changed. Generally speaking, taxation is imposed if the blend is done rather than on its purchase or usage. However, you are able to choose to possess tax enforced on its purchase or usage by examining the right package on Form 6627. You can easily revoke this option only with IRS permission. The development of a mix for export and for usage as a feedstock isn't a taxable use of the ODCs contained in the mixture. Exclusions. Listed here might be exempt from tax on ODCs.- Metered-dose inhalers.

- Recycled ODCs.

- Shipped ODCs.

- ODCs used as feedstock.

- Utilized as a propellant in a metered-dose inhaler (the person who utilized the ODC as a propellant may submit a claim),

- Exported (the producer may submit a claim), or

- Used as a feedstock (the one who used the ODC may file a claim).

Imported Taxable Products

a brought in product containing or made with ODCs is subject to taxation if it is entered in to the United States for consumption, use, or warehousing and it is placed in the Imported Products Table. The Imported Products Table is listed in laws section 52.4682-3(f)(6).

The taxation is dependant on the extra weight of ODCs used in the manufacture associated with product. Make use of the after methods to figure the ODC fat.

- The (precise) weight of every ODC used as a product in manufacturing the merchandise.

- If actual body weight cannot be determined, the ODC fat detailed when it comes to product within the Imported goods dining table.

However, if you can't figure out the weight while the table doesn't record an ODC body weight for item, the rate of tax is 1per cent of this entry worth of the item.

Taxable occasion. Tax is enforced on a brought in nonexempt product when the item is first sold or employed by its importer. The importer is likely when it comes to tax. Using imported products. You use an imported product if you place it into service in a trade or business or for producing income or make use of it when you look at the generating of a write-up, including incorporation to the article. Losing, destruction, packaging, repackaging, warehousing, or repair of an imported item actually a use of that item. Entry as usage. The importer might want to treat the entry of a product in to the united states of america as use of the item. Tax is enforced from the time of entry instead of once the item is sold or made use of. The decision relates to all imported nonexempt products that you possess and have now perhaps not used once you result in the option and all later on entries. Make the choice by examining the container in Part II of Form 6627. The option is beneficial by the start of the diary one-fourth that the shape 6627 applies. You are able to revoke this option just with IRS permission. Purchase of article incorporating imported item. The importer may treat the sale of a write-up manufactured or put together in the us since the first sale or usage of an imported nonexempt item incorporated because article if both after utilize.- The importer has consistently addressed the purchase of similar products as the first sale or utilization of similar taxable brought in items.

- The importer has not yet plumped for to take care of entry in to the US as use of the product.

- Its an electric component whoever operation involves the utilization of nonmechanical amplification or changing products such as for instance tubes, transistors, and built-in circuits.

- It includes elements described in (1), which account fully for over 15per cent of price of this product.